how to calculate tax on uber income

To file yearly taxes youll need a Schedule Cform. Since the ruling in August 2015 the ATO requires all Uber drivers to register for GST.

How To File My Income Tax Return Tax Return Income Tax Income Tax Return

Enter your Earnings and ExpensesFor Rideshare Drivers upload UberDiDi tax statement to fill values automatically.

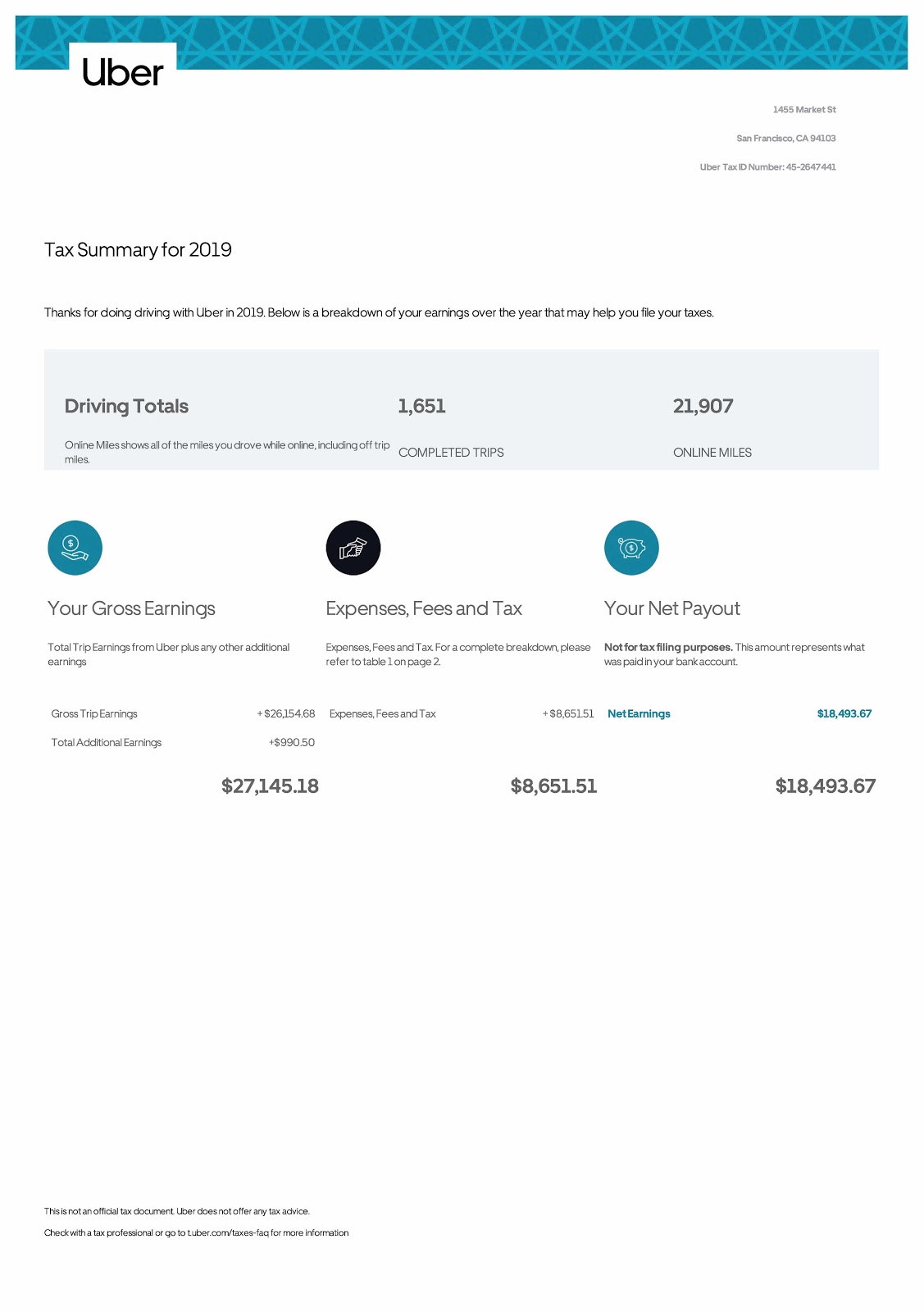

. You can take a medical tax expense deduction only if your overall unreimbursed medical costs exceed 75 of your adjusted gross income AGI. Complications such as rental properties or capital gains may incur extra fees. The Uber tax summary of total online miles includes all the miles you drove waiting for a trip en-route to a rider and on a trip.

She also worked as a paralegal in the areas of tax law bankruptcy and family law from 1996 to 2010. The amount of your standard deduction depends on your filing status. Here are some common questions regarding Uber driver tax deductions.

Click on Additional Expenses to add other possible Expenses. Gross Bookings reached an all-time high of 291 billion up 33 year-over-year Net loss of 26 billion with a 17 billion net headwind relating to Ubers equity investments Adjusted EBITDA of 364 million Operating cash flow of 439 million. If you have multiple Tax statements click on Add New Statement.

You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 16 cents per mile for 2021 or you can deduct your actual costs of gas and oil. For example if youre single and earn 30000 a year youll pay income tax on 17050 30000 - 12950. You can also edit expense name by clicking on it.

Our standard fee for an Uber tax return is 187 and this includes all your Uber income and deductions employee or investment income and deductions and all other parts of your regular tax return. Filing an annual return. Keep in mind this is before you take into account any additional expenses.

Beverly Bird has been a writer and editor for 30 years covering tax breaks tax preparation and tax law. There is an exemption from reporting foreign asset which was acquired while the foreign national was an NR in India and from which no income is earned during the financial year. But there may be serious Uber tax problems ahead unless you do it right.

Do Uber Drivers Pay GST. This lets you calculate the work-related portion of your car use in a way that the ATO respects. You can find all the information in the blog post above.

If you want to learn about paying income tax please visit our blog. Then you can properly claim a wide range of vehicle-related expenses. Youll need to submit the GST portion of your Uber fares to the ATO in addition to the tax you pay for your income as an Uber driver.

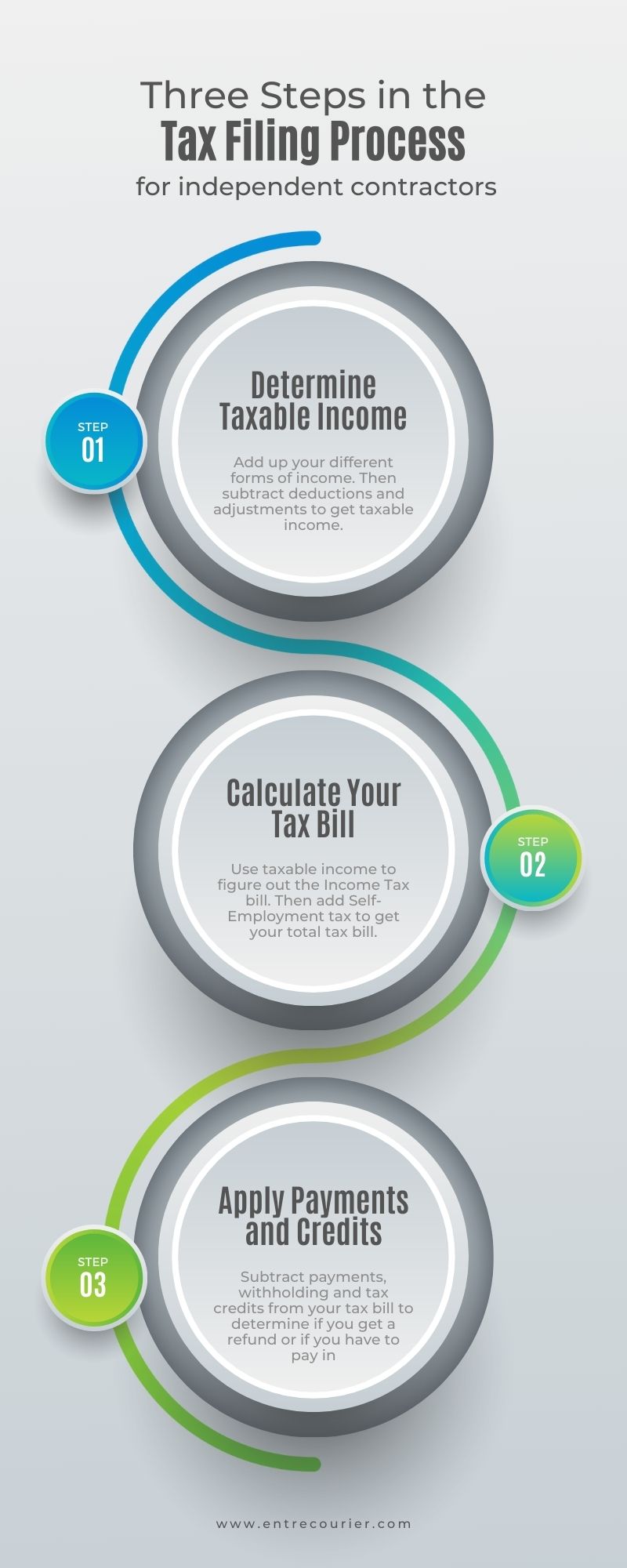

As a self-employed individual you are generally responsible for estimated quarterly tax payments and an annual return. You can take this tax break and still write off your business expenses on top. Even where an ROR does not have any taxable income in India a tax filing requirement arises if the individual has any assets outside of India.

UBER today announced financial results for the quarter ended June. If you have paid higher tax to the government in the previous financial year FY ie FY 2019-20 then you are required to file your income tax return ITR to claim the refund amount. The normal 75k GST threshold does not apply to Uber and taxi drivers so you must register for GST from the first 1 you earn.

Finally click Calculate GST to see you GST. Higher tax is usually paid when during the financial year the advance tax paid by an individual self-assessment andor tax deducted at source TDS is more than their tax liability. There are two ways to calculate the business use of your car.

Uber Driver Tax FAQs. For 2022 those figures are. Beverly has written and edited hundreds of articles for finance and legal sites like GOBankingRates PocketSense LegalZoom and more.

According to our figures drivers in Australia have an average income of 3315 per hour before Uber takes its 275 cut. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e-filed or printed not. Free cash flow of 382 million Uber Technologies Inc.

GoSimpleTaxs software uses the information you upload in real time to calculate your income and expenditure working out the tax you owe and sending you helpful notifications when there. You are responsible for federal and state if applicable taxes on your adjusted gross incomeSo the more tax deductions you can find the more money youll keep in your pocket. Uber has taken Australia by storm as a great way to earn additional income.

Automatically Calculate Income Expenditure and Tax Owed Gone are the days of fretting over a calculator surrounded by scraps of paper at the eleventh hour.

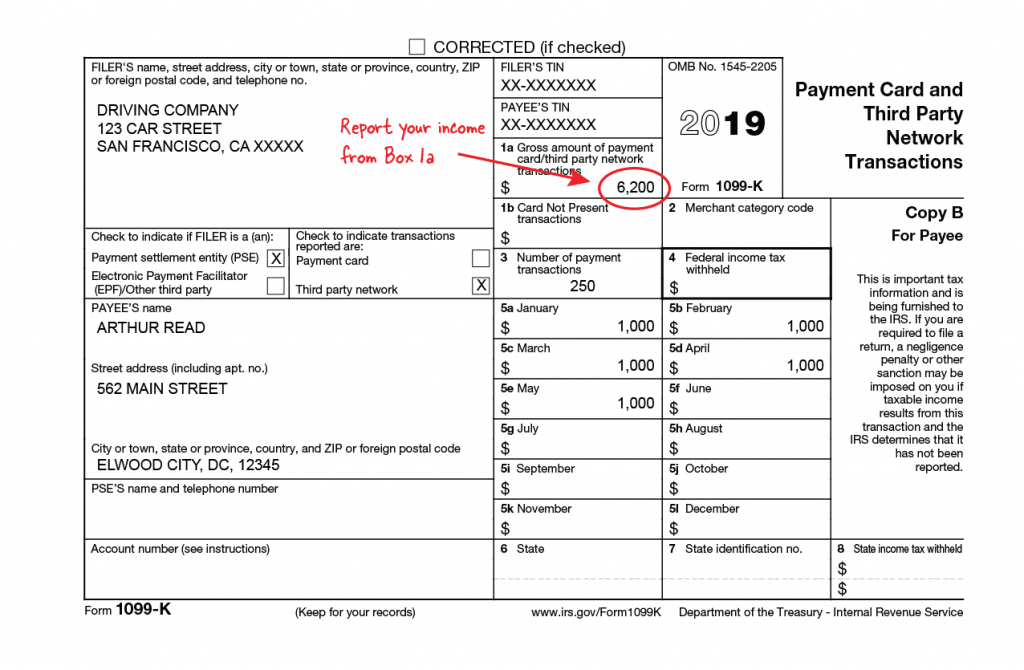

Uber Tax Forms What You Need To File Shared Economy Tax

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr Uber Tax Uber Driver

How Do Food Delivery Couriers Pay Taxes Get It Back

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

The Uber Lyft Driver S Guide To Taxes Bench Accounting

Tax Tips For Rideshare Drivers Tax Guide For Lyft Uber Drivers

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Taxes For The Gig Economy Uber Drivers And More Tax Economy Tax Help

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Tax Deductions Small Business Tax Deductions

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

How To File Your Uber Driver Tax With Or Without 1099

When You Get To The End Of March There Are A Bunch Of Tax Forms That You Should Have From People D Personal Finance Budget Personal Finance Money Saving Tips

Uber Tax Summary 2021 Compilation Spreadsheet For Uber Drivers Youtube

Rideshare Deductions Standard Mileage Vs Actual Vehicle Expenses Rideshare Deduction Uber

Freelancer S Guide To Quarterly Estimated Taxes Freelancers Guide Business Advice Freelance Writing

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income